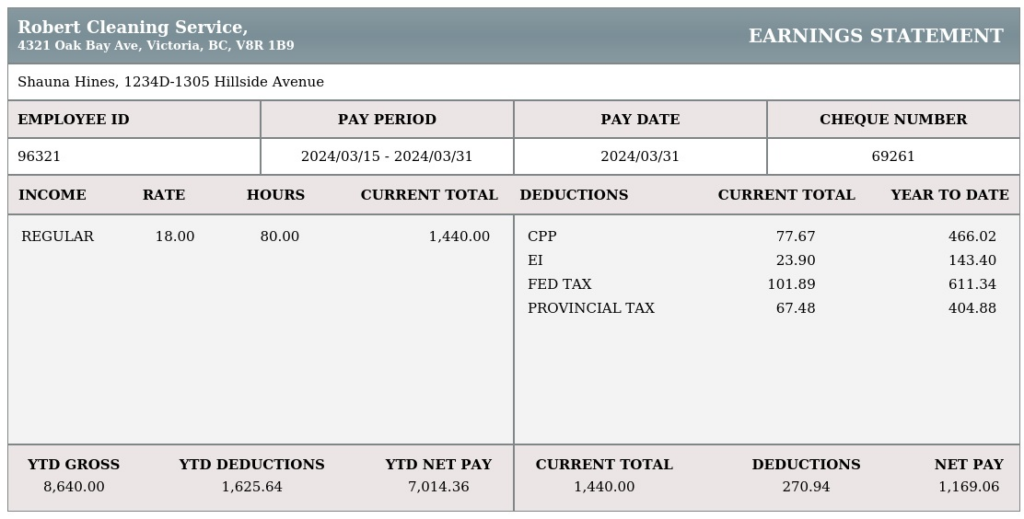

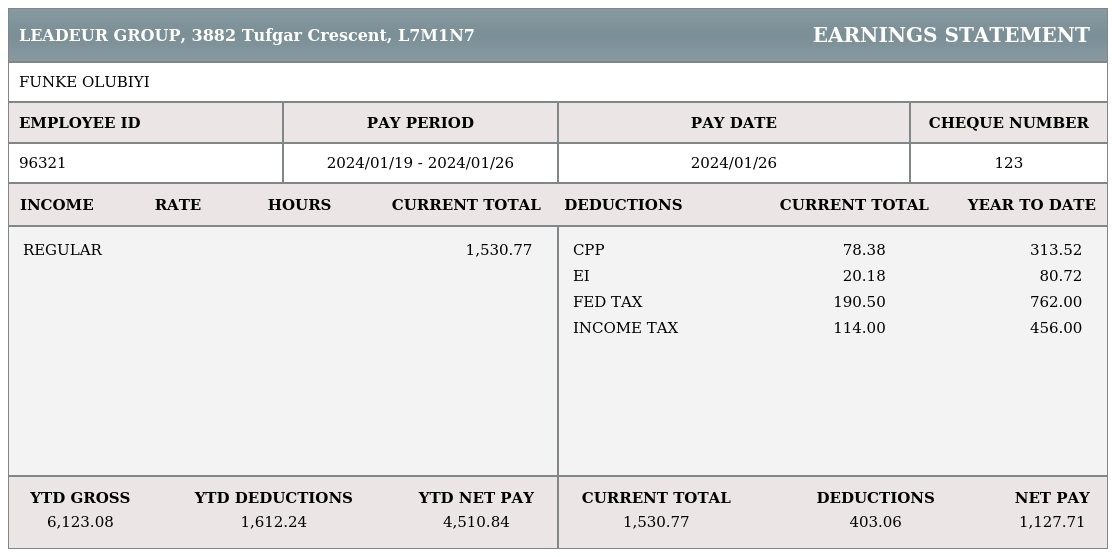

Understand Canadian pay stub deduction

In Canada, pay stub deductions refer to the various amounts withheld from an employee’s gross pay before receiving their net pay. These deductions are mandatory or voluntary and serve different purposes, such as taxes, insurance, and contributions to various funds. Here’s a breakdown of common pay stub deductions in Canada:

- Income Tax: Federal and provincial or territorial income taxes are deducted from your gross pay based on your income level and the province or territory in which you reside.

- Canada Pension Plan (CPP): CPP contributions are deducted to fund the national pension program, which provides retirement, disability, and survivor benefits.

- Employment Insurance (EI): EI premiums are deducted to fund benefits such as maternity and parental leave, sickness, compassionate care, and regular employment insurance benefits.

- Canada Pension Plan (CPP) and Employment Insurance (EI) Overpayments: If you’ve overpaid into CPP or EI in the past, adjustments may be made on your pay stub to account for these overpayments.

- Pension Plan Contributions: If you’re enrolled in an employer-sponsored pension plan, contributions may be deducted from your pay to fund your retirement benefits.

- Union Dues: If you’re a member of a labor union, union dues may be deducted from your pay to cover membership costs and support union activities.

- Health Insurance Premiums: If your employer offers health insurance coverage, premiums may be deducted from your pay to contribute to the cost of the plan.

- Other Benefits: Deductions may also include contributions to other benefit programs offered by your employer, such as dental or vision insurance.

- Charitable Contributions: Some employers offer payroll deduction programs for charitable donations, allowing employees to contribute to charitable organizations directly from their pay.

- Other Deductions: These can include deductions for uniform expenses, garnishments, or court-ordered payments.

It’s important to review your pay stub regularly to ensure accuracy and understand where your money is going. If you have questions or concerns about any deductions, you can consult your employer’s HR department or a financial advisor for clarification. Additionally, keep in mind that tax laws and deduction rates may change, so staying informed about updates is crucial.